BATTLE FOR THE BANDS

Another brief diversion today from my ongoing series of blogs covering TV signature tunes from the past 60 years. They'll pick up again over the weekend, but news is bubbling away about another round in the battle for the music-consuming public's hard-earned cash. The battle is between the major digital download sites and the increasing number of streaming services. The aim is to sign exclusivity agreements with bands for album releases - and thus prevent rivals from being able to download or stream them as well. The prize is to take a near monopoly in providing access to new music.

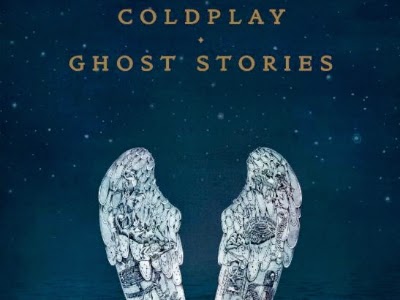

|

| Coldplay - Ghost Stories The new album at the centre of an on-line exclusivity agreement |

It's been brought to a head by the runaway success of the new Coldplay album, Ghost Stories. With most album sales on a gradual slide, Coldplay are one of the few *big hitters* and sales of 106,000 copies during its first two days of release is testament to that. Apple - via its download service iTunes - agreed an exclusivity agreement with the band. This allowed iTunes to stream it via their download service a week in advance of release - and prevents Spotify from streaming it at all. On the surface, this looks like a band trying to encourage a monopoly, but we need to dig beneath the surface and see what else is at play in this digital clash of the titans.

iTunes sell individual songs or whole albums to the consumer. The price varies slightly, but it's usually less than a physical CD - but still more than the Spotify Unlimited service which is £4.99 per month. A download enables the consumer to have a copy of the file to play on a range of devices - and no further cost is incurred. Spotify has three levels of service - a free streaming service which is paid for by frequent advertising in between songs; the Unlimited Service at £4.99 (which is closed to new customers) and the Premium Service which costs £9.99 a month. The Premium Service allows off-line access and an enhanced sound quality.

|

| Thom Yorke of Radiohead: Won't let their albums be used by streaming sites |

On the face of it, the consumer might be attracted by Spotify Premium, but it does mean a regular payment of £9.99 per month: stop paying - and the service is blocked. The other downside is to the artist - Spotify pays an artist £0.0004 per stream, but for many new artists, there is no payment at all, leading to Radiohead withdrawing their albums from the service in 2013.

iTunes costs the consumer around £0.89 per song downloaded - some are more, some are cheaper. Consumers are buying downloads on a lifetime basis, rather than paying for streaming access each and every month. iTunes pays artists a lot more than Spotify for having their music available on its download service - but it is also concerned that streaming services take away some of the potential purchases - hence the desire for exclusivity agreements. Artists thus far don't seem too uncomfortable with this because they know that they'll earn more out of iTunes for a given release if *sales* aren't undermined by Spotify streaming the songs as well. But - and here is a key issue - at what point do fans and consumers start to get fed up with the creeping growth of a digital monopoly?

|

| Beats Electronics - bought by Apple for $3.2bn |

Spotify claim to have over 40 million active accounts across some 56 countries, each paying a monthly subscription. They have signed up Oasis and Led Zeppelin to their service. There is much money for Spotify to make - even if artists don't feel that they are getting their fair share. But, if bands are closed off to them, their customer base could shrink. Quite apart from this, Apple has recently bought Beats Electronics for $3.2 billion and is likely to be using their expertise to launch its own streaming service alongside its iTunes download service.

Hence the Coldplay exclusivity agreement looming large in this Battle For The Bands. By choking off access to the big acts by Spotify - and then launching its own streaming facility, is Apple looking to provide a knock-out punch? This takes us back to the reality of albums sales: they are in decline and even Coldplay's new release is likely to sell fewer copies than its predecessor Mylo Xyloto. If the future is streaming-shaped, what can Spotify seek to do to protect its subscription base? Exclusivity agreements are less likely whilst their *band rewards* are meagre - or at least perceived to be so by the artists. They need to reassess where they stand and adapt their model - rather than placing messages on their subscriber streaming service *grumbling* that certain artists have "decided not to release (their new) album on Spotify".

And the consumer?

|

| Seconds Out - Round Two |

Unlike an old High Street record store where a music fan can buy or order any release, the current download/streaming battle means multiple accounts and formats are needed to get the range of music they might like to buy. This may not be an issue that often, but it's a poor sign that a digital service which can make the buying process simple and painless is actually making it overly complex.

No doubt Round Two of this Battle For The Bands will be as equally frustrating and perplexing.

Alan Dorey

22nd May 2014

Spotify simply HAVE to pay us(The Artists) more to survive in the future-or nobody will be on it. Many of us have stuck with them -giving them a kind of trial period-but now they are clearly making money and the musicians are still not-it`sd inevitable what will happen.

ReplyDeleteI think you are quite right: someone's making money and it ain't the artists!

DeleteOne could be flippant and say, who wants to buy Coldplay anyway?

ReplyDeleteBut flippancy aside, this will not end well. These "Exclusive" deals are a monopoly and the only person that gains is the likes of itunes. Everyone else suffers; the consumers and the artists. There is a reason for my doom laden prophecy. it happened in the comic book industry and brought that industry near to crashing to its knees.

Of course it's not an exact parallel but close enough. After Marvel experimented with self distribution and threw the distribution companies into a tizzy, Diamond Distributors signed an exclusivity deal with DC. This meant that the biggest selling titles (X-Men, Spider-Man) couldn't be supplied to comic book stores by any distributor except Heroes World (Marvel) and Batman and Superman (DC) by Diamond. That left Capital distributors with Kitchen Sink, Viz (Manga) and smaller publishers. Capital was forced to sell to Diamond and by 1996 Diamond has a monopoly on comic book distribution in North America and across parts of the globe. Diamond escaped an Antitrust suit because they did not have a monopoly on books and other merchandise, just comic books. So now both publishers, creators and consumers are at the mercy of Diamond. Diamond sets the price, Diamond gives or takes away prominence, there have been allegations of censorship and blocking publications.

The same will happen with online sales and streaming. Just on major distributor with a monopoly. One winner and everyone else loses.

I think you're very near the mark there Jeff: I know your experience in the comics business is not exactly the same, but it does have a ring of truth about it. The destination will be the same even if the journey take a slightly different route.

DeleteThis is relevent to the discussion I believe.

ReplyDeletehttp://bits.blogs.nytimes.com/2014/05/23/amazon-escalates-its-battle-against-hachette/?_php=true&_type=blogs&_php=true&_type=blogs&_r=1&

It is: as others have said elsewhere, the issue here with Amazon flexing its muscles is that once it has its monopoly over the publishers and us, the readers, it'll be able to use whatever pricing model it likes. I do use Amazon out of convenience - but, given the chance, I do like to support local books stores. There's room for both....

ReplyDelete